Pay Any Vendor, From Any Source, And earn 2% Cash Back

.svg)

Companies use multiple payment methods & are often delayed on payments

Compliance is ignored

No central database

Unreliable OCR systems

AP teams spend 100s of hours booking invoices

Compliance is ignored

No central database

Unreliable OCR systems

Scattered Payment Sources

Manual Reconciliation Mayhem

Penalties For MSME Payments

Enterprise Payments Platform built for large Indian enterprises

Explore our entire suite of Corporate Finance Automation Products

Understanding Multi-Bank Payments & How It Impacts Your Business

This approach also enhances payment efficiency by streamlining processes, allowing faster and more accurate transactions across different accounts. Moreover, it mitigates risk by diversifying financial resources, ensuring business continuity even if one bank faces issues. Overall, multi-bank payments provide greater flexibility, security, and control, directly impacting your business's financial health and operational efficiency.

How Multi-Bank Payments Work: A Step-by-Step Guide

Step 2 - Payment Processing: Payments are processed through the optimal account based on balance and transaction type, ensuring efficient payment processing and cash flow.

Step 3 - Automated Reconciliation: Post-payment, the system uses automated payment workflows to match transactions with accounts, simplifying bank reconciliation and reducing errors.

Step 4 - Transaction Tracking: Real-time transaction tracking allows for seamless monitoring and management of payments across multiple accounts.

Step 5 - Security and Compliance: The system ensures secure payment processing and adherence to financial regulations, guaranteeing that all transactions are safe and compliant.

Multi-bank payments allow businesses to optimize cash flow by distributing payments across multiple bank accounts. This ensures better liquidity management, as funds can be drawn from the most favorable accounts, reducing the risk of overdrafts and enhancing financial flexibility.

By leveraging multi-bank payments, companies can streamline the payment process, enabling faster and more accurate transactions. This reduces the administrative burden of managing payments across different accounts and enhances overall operational efficiency.

Multi-bank payments reduce the reliance on a single bank, spreading risk across multiple businesses. This diversification not only enhances financial security but also ensures that payments can continue smoothly even if one bank experiences issues.

Common Challenges with Multi-Bank Payments and Solutions

2. Increased Risk of Errors: Payments across various accounts increase error risks. Implement transaction tracking and secure payment processing to reduce mistakes, while leveraging financial automation and bank account integration for accuracy.

3. Coordination Across Accounts: Coordinating payments across banks can be inefficient. Address this by using financial automation software and multi-bank transfer solutions that integrate with your financial tools for smooth, efficient payments.

Multi-Bank Payments with Reconciliation for Large Enterprises

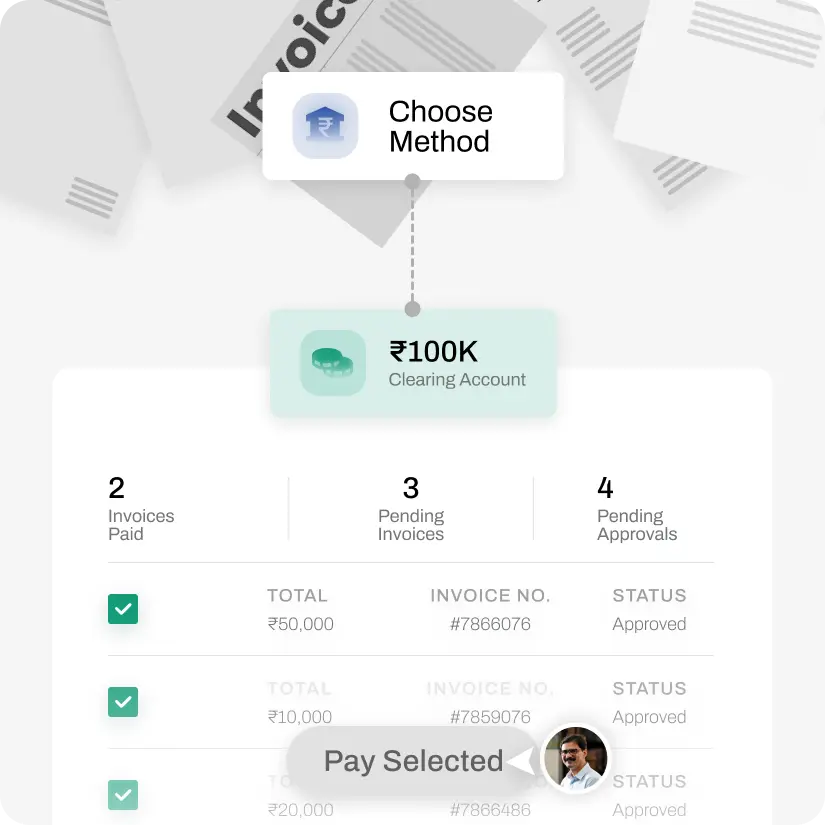

2. Centralized Fund Management:Easily transfer funds to your CashFlo clearing account and manage all payments from one secure location.

3. RBI-Compliant Security:Ensure your funds are always safe and secure with full compliance to RBI guidelines.

4. Robust Clearing Account Foundation:Rely on a strong, secure clearing account to guarantee the safety of your funds at all times.

5. Seamless ERP & WMS Integration:Experience powerful synchronization with your ERP and WMS systems, ensuring smooth payment operations across all platforms.

Effortlessly Pay from Any Bank Account with Auto-Reconciliation.

2. Automatic Reconciliation: Use automated payment workflows and tools to reduce time spent on manual bank reconciliation.

3. Simplified Accounting: Financial automation software matches payments with transactions, minimizing errors through secure payment processing.

4. Enhanced Control: Manage cash flow with efficient bank account management and multi-bank integration, ensuring smooth transaction tracking.

5. Effortless Management: Utilize financial management tools integrated with existing systems for efficient bulk payment processing and reconciliation.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)